Introduction Self.inc :

If you’re working to build credit from the ground up–or rebuilding it after a few financial misadventures–you’re not alone. Millions of other Americans are in the same

predicament: how to build a credit score while staying out of debt. Thankfully, with today’s sophisticated tools like credit builder accounts, secured credit cards, and rent reporting, it is possible to establish a solid credit history while saving money!

This is where Self fits in. Self is designed for people who have established little or no credit history, and we’ll show you a unique path to financial well-being without a credit check. In this entry, we’ll break down how Self works, who it’s for, and how you can leverage the tools from Self to build credit responsibly.

words📈 How to Build Credit and Savings Together with Smart Products

Every credit-building process does not have to be a lonely process—nor do you have to pick between building your credit or building your savings. By using smart tools like credit-builder accounts, secured credit cards, and reporting rent payments, you can strengthen your credit history while you continue to grow your money. Here are the steps to combine your process!

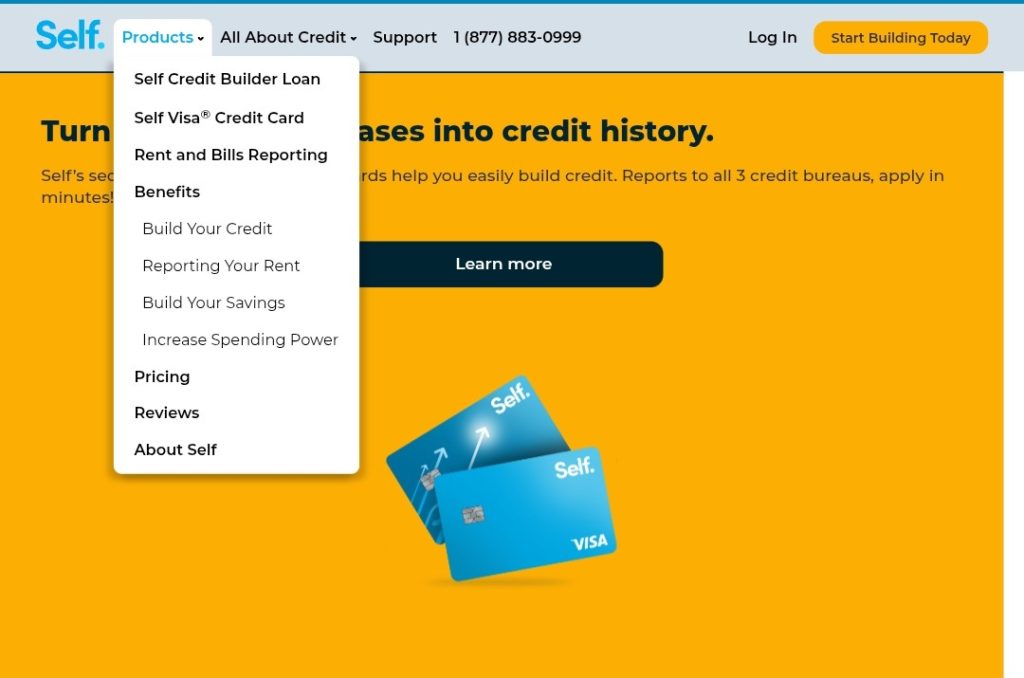

1. What is a Credit Builder Account

Essentially, a Credit Builder Account is a loan, where your money is held in a locked savings account during the duration of your monthly payments. You can think about it like you are getting to pay yourself—each payment builds your credit history, and creates a savings balance to access at the end.

No credit check to open

We’ll report to all three major bureaus

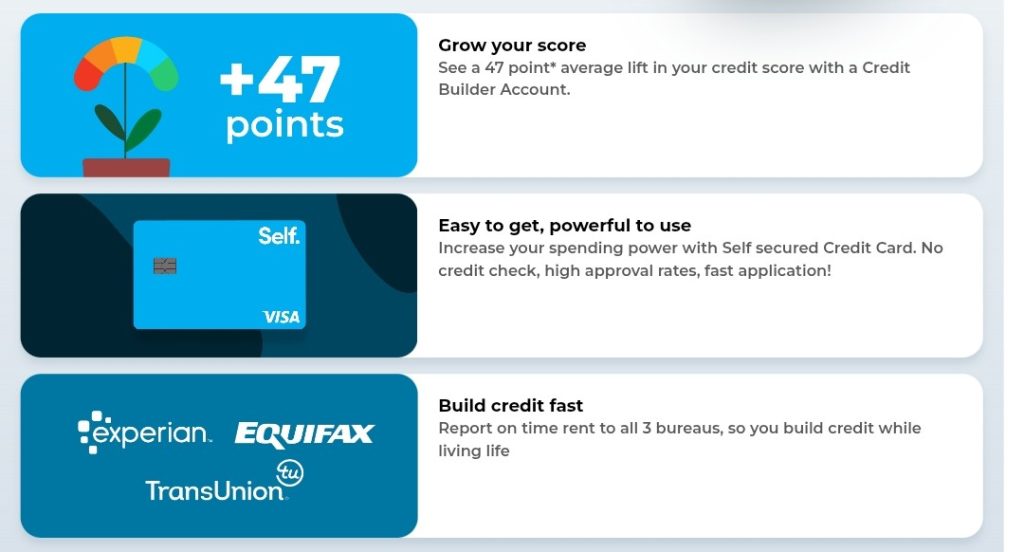

0-5 On-time payments = credit score lift (users can see an average of ~ 47 points lift!)

📌Tip: Choose a payment plan you can easily maintain—payments will typically range from $25 to $150+ monthly.

2. Simple Savings with Built-in Structure

Since your deposits go into a CD-like account, you’re technically saving every month. When the loan ends, you release your savings (less a small fee and some interest). It’s disciplined savings with a target in sight—plus, you build credit along the way.

3. Add the Secured Self Visa® Credit Card

Want a little flexibility for everyday spending? A secured credit card is your next tool:

Low deposit (serves as your credit limit)

No hard credit inquiry to open

Accepted wherever you see the Visa mark

1202-6 On-time usage will build credit with the bureaus

💡 Think of this as a bridge to go from a credit-builder plan to traditional credit—it’s your spending within your means with a positive payment history.

4. Enhance with Rent & Bill Reporting

Did you know that your rent and utilities can help build credit too?

Add Rent, Phone, or Utility Payments to your Credit Builder

1945-3$6.95/month to report to TransUnion, Experian, and Equifax

On time payments will help your credit mix, and offer future improvement opportunities

5. Real Results from Real Users

2325-1″Self has helped improved my credit a lot… it has been a growing and learning experience.” – Bry

2576-0″It’s actually a really good app. My credit score has been increasing…” – Google Play user

Hundreds of thousands of users have shown real improvement to their scores, which shows that consistency and good tools pays off.

6. Getting Started: Step-by-Step Step

What to Do

1️⃣ Open a Credit Builder Account – Choose your monthly amount

2️⃣ Set automatic payments to help you pay on time.

3️⃣ When you are comfortable, apply for the Secured Visa Card

4️⃣ Add rent and utility reporting to amplify you credit building

5️⃣ Monitor your credit score monthly through VantageScore or TransUnion

7. FAQ at a Glance

How quickly until I get a boost?

Most on-time payments will typically be reflected in credit reports in the 30-72 hour window being received by credit bureaus, and most users will see significant score lifts during the first 12 months of usage.

Will every lender use these scores?Most of the largest credit bureaus report your data by many different lenders, but use of the score varies. The importance is that you are consistently making your required payments, on time.

What happens if I miss a payment?Missed payments can negatively impact your credit as well as your savings. Set reminders and/or set up autopay to help you down the right path.

Final Thoughts

Having a Credit Builder Account, a secured credit card and rent/bill reporting all working in concert allows you a stronger, more dynamic way to build credit — and savings — without managing multiple services or taking on debt.We are not just offering a single tool in building credit; we’re creating a dynamic credit-ready toolbox.

If you’re ready to build a more secure financial future, start small, stay consistent and watch as your both your credit—and your confidence improves.